The Global Professional Indemnity Insurance Market Is Expected to Grow at A Significant Growth Rate, And the Forecast Period Is 2023-2030, Considering the Base Year As 2022.

Professional indemnity insurance (PII), also known as professional liability insurance, is a type of insurance coverage designed to protect professionals and businesses against claims of negligence, errors, omissions, or malpractice in the provision of their professional services. It provides financial protection for legal costs, settlements, and damages awarded to third parties who suffer financial loss as a result of professional negligence or misconduct.

the professional indemnity insurance market caters to a wide range of professions and industries, including but not limited to, legal services, accounting, architecture, engineering, healthcare, consulting, and technology.

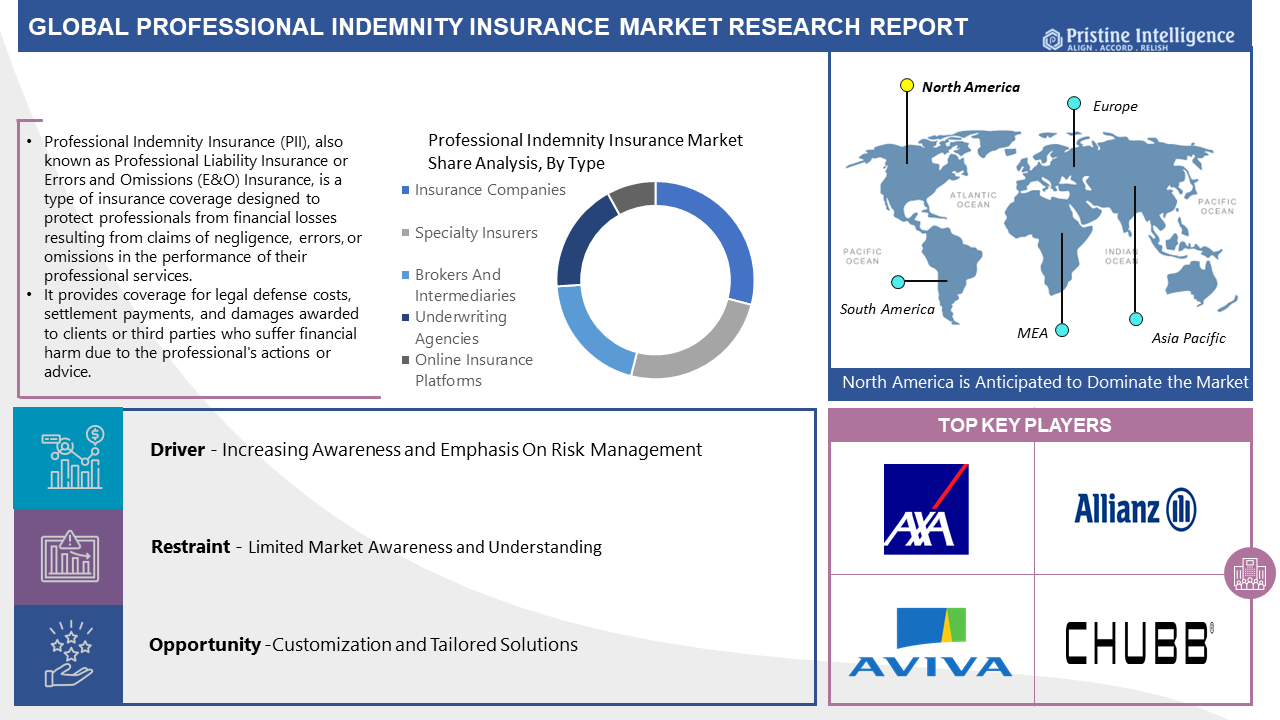

Leading players involved in Professional Indemnity Insurance Market include:

American International Group (AIG) (US), Allianz Global (Germany), Aviva (UK), AXA SA (France), Chubb European (Switzerland), Hiscox Ltd. (Bermuda), Liberty Mutual Insurance Group (US), Manchester Underwriting (UK), Markel International (US), Royal and Sun Alliance (UK), Tokyo Marine HCC (US), Travelers Insurance (US), Zurich Insurance Group (Switzerland), Berkshire Hathaway Specialty Insurance (US), Beazley plc (UK), Generali Group (Italy), Arch Capital Group Ltd. (Bermuda), QBE Insurance Group Limited (Australia), The Hartford Financial Services Group, Inc. (US), CNA Financial Corporation (US) and Other Key Players.

Get free access to Sample Report in PDF Version along with Graphs and Figures @ https://pristineintelligence.com/request-sample/global-professional-indemnity-insurance-market-44

Opportunity: Expansion into Emerging Professions and Markets

An opportunity within the professional indemnity insurance market lies in the expansion into emerging professions and markets where there is a growing demand for specialized coverage and risk management solutions. With the rise of digital technology, innovation, and new business models, new professions and industries are emerging, each with its unique set of risks, liabilities, and insurance needs.

For example, professionals working in fields such as cybersecurity, data privacy, fintech, artificial intelligence, and environmental sustainability face evolving risks and regulatory challenges that may not be adequately addressed by traditional insurance policies.

Segmentation of Professional Indemnity Insurance Market:

By Type

- Insurance Companies

- Specialty Insurers

- Brokers And Intermediaries

- Underwriting Agencies

- Online Insurance Platforms

By Application

- Legal

- Accounting

- Healthcare

- Engineering

- IT

- Others

Business Size

- Small-Size Enterprises

- Medium-Sized Enterprises

- Large-Size Enterprises

Risk Profile

- High-Risk

- Low-Risk

By Region

- North America (Us, Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest Of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest Of SA)

Inquire for Discount on this Report @ https://pristineintelligence.com/inquiry/global-professional-indemnity-insurance-market-44

Owning our reports will help you address the following issues:

- Uncertainty about the future: Our research and insights enable clients to anticipate upcoming revenue opportunities and growth areas, aiding in strategic resource allocation.

- Understanding market sentiments: Gain a comprehensive understanding of market sentiments crucial for strategy formulation. Our insights provide a keen observation of market sentiment through engagement with Key Opinion Leaders across industry value chains.

- Identifying reliable investment centers: Our research ranks investment centers based on returns, future demands, and profit margins, allowing clients to focus on the most promising investment opportunities.

- Evaluating potential business partners: Our research and insights assist clients in identifying compatible and reliable business partners, facilitating strategic collaborations.

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]